Hey there, future homeowner! If you’re reading this, you’re probably thinking about buying a home in Canada — and that’s exciting! But let’s be honest, the mortgage process can feel a bit overwhelming and sometimes you don’t know if there’s anything you should anticipate or research previously to achieve better results. Don’t worry, we’re here to walk you through everything you need to know in plain English (no confusing banker talk here!).

In this guide, we’ll cover:

- Calculating your Mortgage to buy in Canada (hint: our mortgage affordability calculator makes this easy!)

- The latest scoop on RBC mortgage rates, TD mortgage rates, CIBC mortgage rates, and Scotiabank mortgage rates

- The big debate: fixed vs. variable mortgages. Which one’s right for you?

- What Mortgage lenders really look at when deciding to approve you

- Pro tips to get the best possible mortgage deal

We’ll even share some eye-opening stats about today’s housing market to help you make smart decisions.

First Things First: Calculating Mortgage Affordability

Before you start scrolling through dream homes online, let’s talk numbers. Knowing your budget is like having a GPS for your homebuying journey — it keeps you from getting lost in neighborhoods you can’t afford.

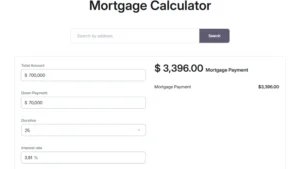

This is where our mortgage affordability calculator becomes your new best friend. By considering factors such as loan amount, interest rate, loan term, and additional costs like property taxes and insurance, this tool gives you an accurate estimate of your payment. It’s super simple to use and helps you:

- See your maximum comfortable home price.

- Understand what your monthly payments would look like.

- Figure out how much you’ll need for a down payment.

Here’s why this matters so much:

Imagine falling head-over-heels for a gorgeous house, only to find out it’s way beyond your budget. Our Mortgage affordability calculator helps prevent your heartbreak by providing realistic numbers upfront.

Here’s a good tip to help you plan: Most lenders follow the “32/40 rule”:

- Your housing costs (mortgage + taxes + utilities) shouldn’t eat up more than 32% of your gross income

- Your total debt payments (including car loans, credit cards, etc.) should stay under 40%

(Source: CMHC – Canada Mortgage and Housing Corporation)

Mortgage Rates in Canada: What’s Happening in 2025?

There’s a lot of factors that influence these interest rates. For example, the Bank of Canada’s impact.

Here’s the latest on mortgage rates from Canada’s big banks (as of June 2025):

| Bank | Fixed Rate (5-Year) | Variable Rate |

| RBC Mortgage rates | 4.390% | 4.550% |

| TD Mortgage rates | 4.64% | 4.79% |

| CIBC Mortgage rates | 4.44% | 4.95% |

| Scotiabank Mortgage rates | 6.390% | 8.150% |

What’s interesting right now?

For the first time in years, fixed rates are actually lower than variable rates. This doesn’t happen often. It could make fixed-rate mortgages more attractive for many buyers. For some, it means that it’s a great time to buy a home in Canada.

The Great Mortgage Debate: Fixed vs. Variable

This is the mortgage version of “pineapple on pizza” — everyone has strong opinions! Let’s break it down so you can decide what’s right for you.

Fixed-Rate Mortgages: The Predictable Choice

✅ Your rate stays the same for the entire term (usually 3-5 years).

✅ Monthly payments never change (great for budgeting).

✅ Peace of mind when rates are rising.

✅ Currently lower than variable rates (bonus!)

This mortgage option is best for: People who sleep better knowing exactly what their payment will be every month.

Variable-Rate Mortgages: The Rollercoaster Ride

✅ Usually starts with a lower rate

✅ Could save you money if rates drop

✅ More flexible if you need to break your mortgage early

❌ Payments can go up (sometimes a lot) if rates rise

This mortgage option is best for: Risk-takers, and market savvy buyers who research, make projections, and believe rates might decrease soon.

Our two cents:

With fixed interest rates being unusually low right now in banks such as RBC, TD, and CIBC they’re looking pretty attractive. But every situation is different. That’s why we recommend chatting with an expert to see what makes sense for you.

What Mortgage Lenders Really Care About

Ever wonder how lenders decide whether to approve you? Here’s what they’re really looking at:

Your Credit Score: Your Financial Report Card

Think of this as your money GPA. Here’s how the numbers break down:

- 800+ = Mortgage valedictorian (best rates!)

- 720-799 = Honor roll material (still great)

- 680-719 = Passing with decent grades (you’ll qualify)

- Below 600 = Might need some extra help (co-signer or alternative lender)

Pro tip: You can check your credit score for free through services like Borrowell or Credit Karma.

Down Payment: Your Skin in the Game

Here’s what you’ll need to put down:

| $500,000 or less | 5% of the purchase price |

| $500,000 to $1.5 million | 5% of the first $500,000 of the purchase price

10% for the portion of the purchase price above $500,000 |

| $1.5 million or more | 20% of the purchase price |

(Source: Government of Canada)

Debt Ratios: The Lender’s Calculator

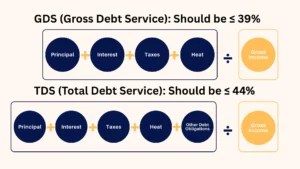

Lenders use two special formulas:

- GDS (Gross Debt Service): Should be ≤ 39%

(Principal + Interest + Taxes + Heat) ÷ Gross income - TDS (Total Debt Service): Should be ≤ 44%

(Principal + Interest + Taxes + Heat + Other debt obligation) ÷ Gross income

Insider Tips to Score the Best Mortgage

Now for the good stuff – how to get the best possible deal and increase mortgage affordability!

Shop Around Like It’s Black Friday

Different lenders offer different rates and perks. Make your initial assessment with our Mortgage Affordability Calculator, and then shop around. Don’t go directly to your usual bank. Check out:

- Other big banks (mortgage rates from RBC, TD, CIBC, Scotiabank give you different options and conditions)

- Credit unions

- Online lenders

- Mortgage brokers (they can compare multiple lenders at once)

Get Pre-Approved (Not Just Pre-Qualified)

A pre-approval is like a golden ticket when house hunting. You can get it through Mortgage lenders or Mortgage brokers. What it does:

- Locks in a rate for 60-130 days (depending on the lender)

- Shows sellers you’re serious

- Gives you a clear Budget

(Source: Government of Canada)

Consider Mortgage Insurance (If Needed)

If you’re putting less than 20% down, you’ll need mortgage insurance (through CMHC or others). It adds 0.6%-4.5% to your mortgage, but lets you buy sooner.

Look Beyond Just the Interest Rate

The lowest rate isn’t always the best deal. Also consider:

- Prepayment privileges (can you pay extra without penalties?)

- Portability (can you take your mortgage to a new home?)

- Penalties for breaking your mortgage early

Let’s Wrap This Up: Your Mortgage Action Plan

Whew! That was a lot of info, but now you’re way ahead of most homebuyers. Here’s your quick action plan:

- Crunch your numbers with our mortgage affordability calculator

- Check your credit score (know where you stand)

- Compare current rates from different lenders

- Decide fixed vs. variable based on your comfort with risk

- Get pre-approved before you start serious house hunting

Remember, buying a home is a big decision, but it doesn’t have to be scary. With the right knowledge and tools (like our handy calculator!), you’ll be unlocking your front door in no time.

Ready to take the next step? Try our mortgage affordability calculator today – it’s free, easy to use, and could save you time and money!