If you’ve been thinking about buying a home in Ontario, this could be the perfect time to make your move. We’re constantly evaluating market dynamics, and with the latest Bank of Canada interest rate announcements and average pricing information, we urge you to plan for a purchase in the coming months. The financial landscape currently favors those looking to enter the market, as lower borrowing costs mean increased affordability—the key rate is now at 2.75%, a substantial drop from the 5% peak in July 2023. Sellers should also start to benefit from renewed buyer confidence, as the market stabilizes, and spring listings bloom in the coming months.

For those wishing to maximize their gains, timing is crucial. While the current balanced market offers fair conditions for both buyers and sellers, experts anticipate increased competition as we move further into spring and summer. Those who act now could take advantage of today’s relatively lower prices and mortgage rates before seasonal demand drives up competition. Aligning your real estate strategy with these market realities can make the difference between securing a great deal and missing out on a prime opportunity.

Why Ontario is a Prime Choice for Homebuyers

There are several reasons why Ontario stands out as a top destination for homebuyers:

- Economic Opportunities are key: Ontario is not just Canada’s economic hub but place with good job stability and growth opportunities, particularly in cities like Toronto. This makes it an ideal place for long-term investments.

- Education and Community are top: Families often move to Ontario for its top-tier schools and strong sense of community. Many neighborhoods provide access to excellent education, recreational facilities, and family-friendly spaces.

- Urban and Suburban, take your pick: Ontario strikes a balance with cities offering bustling urban life alongside spacious suburban areas perfect for those seeking greenery and tranquility.

Market Trends in Ontario — Understand the numbers

The real estate market in the province continues to show resilience despite broader economic challenges. Specific territories, like Mississauga and Toronto, have unique market trends that could work in your favor if you’re planning on buying a home in Ontario. Here’s a snapshot of what’s happening:

Mississauga Condo Market Trends

| Period | Interest Rate | Avg. Condo Price | Market Type |

| April 2022 | 1% | $707,181 | Seller’s Market |

| July 2023 | 5% | $676,903 | High-Interest |

| Feb 2025 | 2.75% | $581,431 | Balanced / Buyer’s Market |

“What am I looking at?”

Prices have dropped significantly since 2022, but with rates now declining, demand is expected to rise — making spring 2025 a prime window if you’re buying a home in Ontario.

Toronto Condo Market Trends

| Period | Interest Rate | Avg. Condo Price |

Market Type |

| April 2022 | 1% | $789,869 | Seller’s Market |

| July 2023 | 5% | $735,171 | High-Interest |

| Feb 2025 | 2.75% | $688,055 | Balanced / Buyer’s Market |

“What does this mean?”

Toronto’s condo prices have adjusted downward, but with lower rates, buyers now have more purchasing power than in years.

Buyer’s vs. Seller’s Market: What the SNLR Tells Us

Understanding whether the market favors buyers or sellers is essential for making informed real estate decisions, and the Sales-to-New-Listings Ratio (SNLR) is one of the most reliable indicators for gauging these conditions. This metric, which compares the number of home sales to new listings in a given period, provides insight into the balance between supply and demand.

According to the Canadian Real Estate Association (CREA), as of February 2025, Canada’s SNLR sits at 49,90%, firmly within the range of a balanced market. This means neither buyers nor sellers hold a distinct advantage—a scenario that offers stability and fair opportunities for both parties. For buyers, this translates into a reasonable selection of properties without the frenzied bidding wars characteristic of a seller’s market. For sellers, it means well-priced homes in desirable areas can still attract serious offers, albeit without the extreme premiums seen in hotter conditions.

However, market dynamics are rarely static—no surprise there. An SNLR above 60% would indicate a shift toward a seller’s market, where limited inventory drives up competition and prices. Conversely, a ratio below 40% would signal a buyer’s market, where ample supply gives purchasers more leverage in negotiations. With spring traditionally bringing increased activity, the current equilibrium may not last long. Buyers who secure properties now can avoid potential price hikes, while sellers who list in the coming weeks may benefit from growing demand before new inventory floods the market.

How To Take Advantage of Ontario’s Current Market

Understanding the current market can be beneficial not just for investors looking for the best moment to find a great deal, but for first-time buyers who can explore financial options with greater ease. Sellers should also strategize and consider our recommendations below.

Advice for first-time buyers

The current environment offers a unique opportunity to enter the market with greater affordability and less pressure than in recent years.

- One of the most critical steps is securing a mortgage pre-approval at today’s lower rates, which not only clarifies your budget but also strengthens your position when making an offer.

- If you want to buy a home in Ontario that can grow in value, focusing on neighborhoods with strong long-term growth potential—such as emerging areas in Mississauga or undervalued pockets of Toronto—can be a great move.

- Working with an experienced agent is essential here, as they can identify properties that meet your criteria while avoiding overpaying in a balanced market.

- Take advantage of homebuying programs and incentives, such as the Home Buyer’s Plan (HBP), that allows you to withdraw up to $60,000 from your registered retirement savings plan (RRSP) tax-free to buy your first home.

Considerations for savvy sellers

Sellers, on the other hand, should approach this period with a strategy that highlights their home’s best features while acknowledging the balanced conditions.

- Pricing competitively from the outset is key, as overpriced listings in a balanced market often linger, leading to eventual price reductions that weaken seller leverage.

- Small but impactful upgrades, such as fresh paint, professional staging, or minor kitchen modifications, can make a significant difference in attracting buyers.

- Since the spring market is likely to bring more listings, acting now allows sellers to capitalize on the current demand without facing excessive competition from other properties.

A final call for smart investors!

If you’re thinking of investing, don’t miss out on the opportunity of buying a property in Ontario, as the combination of lower rates and adjusted prices creates favorable conditions. Whether considering condos in Toronto’s rental-heavy neighborhoods or multi-family units in Mississauga, locking in financing at current rates can enhance cash flow and long-term returns. Diversifying into markets with strong fundamentals—such as proximity to transit, universities, or employment hubs—can further reduce risk while positioning for appreciation.

Final Thoughts On Ontario’s Market Opportunities

With prices still below previous peaks and borrowing costs significantly reduced, those who act decisively in the coming months stand to gain the most. The window of opportunity, however, may not remain open indefinitely. As the spring market slowly opens up, increased activity could lead to tighter competition and an upward pressure on prices.

Whether you’re looking to buy your first home, sell a property, or make a strategic investment, partnering with a knowledgeable real estate professional can give you the competitive advantage you seek. If you’re still doing your research, you can also explore our Heatmaps, designed to help you make data-driven decisions, or do some budget simulations with ours calculators.

This could be the sign you were waiting for to buy a home in Ontario. Take advantage of this province and its incredible potential now.

Listings to look out for:

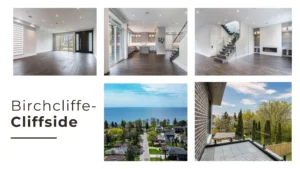

A delightful home in Birchcliffe-Cliffside

A luxurious retreat at Birchcliffe awaits—your dream family home surrounded by nature. With 4+2 spacious bedrooms, 7 elegant bathrooms, and a spacious backyard, this property perfectly blends comfort and sophistication.

Perched along the sought-after Scarborough Bluffs, this neighborhood offers breathtaking views of Lake Ontario. Just steps from your door in Birch Cliff, you’ll find trails, beaches, gardens, and even dog-friendly parks—perfect for outdoor moments with kids and pets.

Love to entertain? The chef-inspired, oversized kitchen and a seamless open-concept dining area set the stage for unforgettable dinner parties. Step outside to dine al fresco in the backyard, complete with a dedicated gas line for effortless Sunday BBQs.

Downstairs, you’ll discover a fully equipped recreational haven. This spacious basement features a second kitchen, a wet bar, 2 additional bedrooms, and 2 full bathrooms—ideal for hosting overnight guests or creating the ultimate entertainment zone.

This isn’t just a home; it’s a lifestyle designed for your family to thrive and grow. Explore the natural charm and modern luxury of this Birchcliffe gem today.